Why monetisation on digital platforms still fails to pay off on the continent

In a continent bursting with digital creativity, African content creators are mastering the art of storytelling, humour, dance, fashion and commentary—sometimes all in the same 30-second TikTok video. What they are not mastering, however, is monetisation. Not for lack of trying.

Take Nigerian YouTuber Tayo Aina, who once garnered over a million views with a viral video covering J. Cole’s concert in Lagos. His reward? A mere $132 from YouTube. Creators elsewhere would have earned ten times as much. The disparity isn’t due to poor content or lack of audience. The problem lies deeper—in the way digital platforms value (or rather, under-value) African traffic, and in the structure of Africa’s advertising economy.

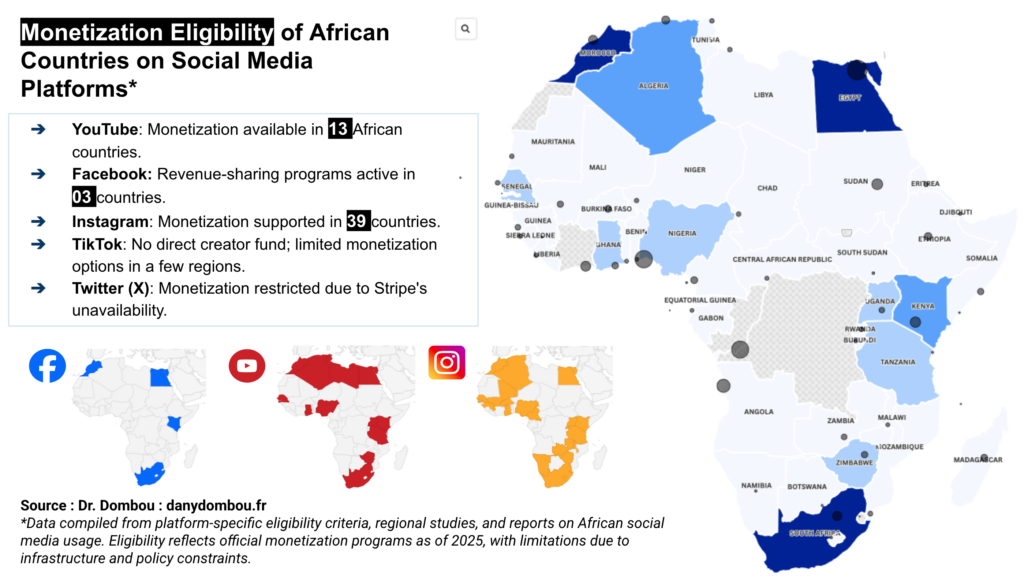

Most global platforms—YouTube, Facebook, TikTok, and Instagram—rely on advertising to pay creators. But monetisation tools are only partially available in Africa. YouTube Partner Programme is officially available in just 13 out of 55 African countries. TikTok’s Creator Fund doesn’t exist on the continent. Facebook’s ad-sharing tools are limited to a few North African markets. And Twitter (now X) pays creators through Stripe, a service largely unavailable in Africa.

Even when monetisation is technically possible, it’s rarely profitable. African creators suffer from dismally low cost-per-mille (CPM) rates. While advertisers in the US or Australia may pay $30 or more per 1,000 views, rates in Africa often hover below $5. Advertisers simply do not value African eyeballs the same way. That’s partly because few foreign brands see Africa as a priority market—and local businesses are not picking up the slack.

Why not? The vast majority of African businesses are SMEs or informal enterprises. Few allocate budgets for digital advertising. Many prefer traditional tactics: word-of-mouth, flyers, local radio. Others distrust online platforms or lack the digital skills to run targeted ad campaigns. Even for willing advertisers, payment barriers (like the absence of local currency billing or mobile money integration) make access difficult.

So, creators turn to brand partnerships, product placements and offline gigs. But even these have limits—especially when local brands lack deep pockets. The irony is painful: Africa has one of the world’s fastest-growing digital audiences, yet its creators earn the least.

What can be done?

First, digital education is key. Many SMEs remain unaware that digital ads can be precisely targeted and cost-effective. Training initiatives by Google, Meta and local NGOs are helpful, but must scale further. Second, platforms must adapt: accept mobile money, simplify interfaces, and expand monetisation tools continent-wide. Third, local success stories must be spotlighted—nothing converts sceptics like seeing their neighbours succeed.

Finally, a new generation of African creators is not waiting. They are inventing alternative models—private WhatsApp groups, affiliate links, crowdfunding, even virtual “tip jars” via mobile money. It’s a patchwork system, but it shows a continent finding its own monetisation path.

For now, African creators continue to hustle, entertain, and educate—often for passion more than profit. The platforms may not yet pay them what they deserve. But one day, perhaps soon, a young Kenyan TikToker will open her app and discover she’s made enough to fund her business, not just feed the algorithm.

And when that day comes, Africa’s digital creators will no longer just go viral. They’ll finally go viable.

Read more here : https://danydombou.fr/publicite-numerique-en-afrique-pourquoi-les-pme-nosent-pas-investir/