Tribune written in 2022, at the time rumors were circulating about an FCFA devaluation

For the past few weeks, rumors of a “subtle” devaluation of the FCFA have been spreading, generating both curiosity and fear on social media. According to those who support this thesis, the continued rise in market prices and the loss of purchasing power in Cameroon (and in other FCFA-using countries) would be the result of a strategy aimed at insidiously devaluing the FCFA.

At first glance, this reasoning appears plausible: in just a few months, the price of many staple goods has risen significantly. The most frequently cited example is refined cooking oil, with the liter allegedly going from around 1000 FCFA to 1800 FCFA. Consequently, with a budget of 10,000 FCFA, a household can now only afford 5 bottles of oil instead of 10. Cameroonians continue to work just as much — if not more — yet their purchasing power is declining, which seems to suggest a de facto devaluation of the currency.

However, it is crucial to recall that, from a technical standpoint, devaluation is defined as a decision by the institution responsible for managing a currency to reduce its official exchange rate relative to other currencies. In the case of the FCFA, no such official decision has been made by the member states of the BEAC. We therefore cannot speak of a “devaluation” in the strict sense. It might be more appropriate to refer to a “depreciation,” but this typically applies to currencies under a floating exchange regime, which is not the case with the FCFA.

The generalized price increase and the loss of purchasing power can instead be attributed to rampant inflation, which has also affected the euro since the onset of the Covid-19 crisis and the war in Ukraine.

A brief historical overview of FCFA devaluation

The FCFA was created in 1948 as a common currency for French African colonies, with a fixed parity to the former French franc (FF). Until January 1994, the official rate stood at 50 FCFA to 1 FF (approximately 280 FCFA to 1 US dollar). Following the 1994 devaluation and France’s adoption of the euro, the parity was set at 655.957 FCFA to 1 EUR. This first official devaluation was implemented as a response to the economic and financial crisis affecting member countries, including Cameroon, which had been hit hard by the downturn in its agricultural and oil exports.

Today, the Cameroonian economy is not at its peak, but it is not in a crisis severe enough to justify a devaluation. Despite declining oil prices in 2015, security, social, and political crises in 2016 and 2018, as well as the Covid-19 pandemic and the effects of the war in Ukraine, Cameroon still maintained a positive growth rate of 0.7%. The country has successfully diversified its economy, and inflation remains below the community threshold set by the BEAC (the same holds true for most other countries in the zone). From a strictly economic viewpoint, it is therefore difficult to speak of a “subtle” devaluation.

The geopolitical argument

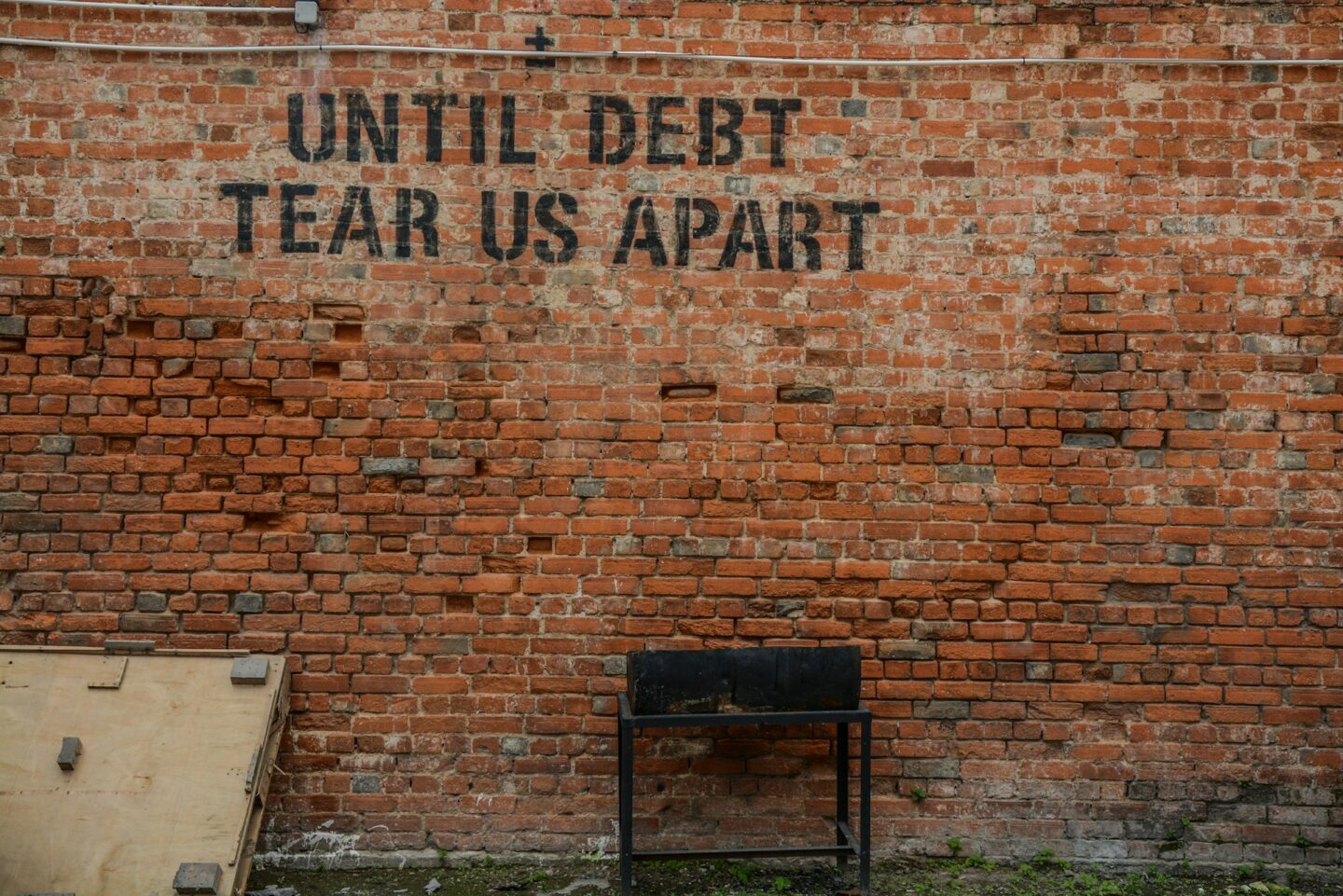

Others put forward a “geopolitical” argument: that there are hidden interests prompting FCFA-using states to pay off their external debts to those supposedly orchestrating the devaluation. However, as the FCFA is pegged to the euro, repaying debt in euros is, in relative terms, equivalent to repaying it in FCFA. A so-called “subtle” devaluation would have no specific effect on servicing euro-denominated debt.

On the other hand, the depreciation of the euro (and thus the FCFA) against the dollar makes dollar-denominated debts more expensive to repay. In 2022, the dollar reached a historically high level against the FCFA, making it costlier for Cameroonians to settle debts in USD. The euro has also experienced depreciation, reducing the ability of Europeans to meet some of their financial obligations. Meanwhile, currencies such as the Chinese yuan or the Russian ruble have gained value against the euro, thus raising the cost of transactions (and debt repayment) for many African countries.

According to a report from Cameroon’s Ministry of Finance, in 2019, 76.3% of the country’s public debt was denominated in foreign currencies, including 29.4% in euros. This portfolio includes debt in US dollars and Chinese yuan, and some estimates suggest that China holds more than 50% of Cameroon’s bilateral debt.

What about the fixed parity?

Thus, the real question behind these rumors might be: does the FCFA’s fixed parity with the euro still reflect the actual situation and economic potential of the franc zone countries? Given the resilience shown by these countries during recent crises, it may be worth re-examining the usefulness of maintaining this peg or considering alternative currency management arrangements.

Dany R. Dombou, Cameroonian economist

Original version of the article available here: https://ecomatin.net/faut-il-se-preparer-a-une-devaluation-du-fcfa2